Year-end processing encompasses several areas already discussed or will be discussed in the next post of the 10 most critical factors of SP payroll series.

Year-end processing encompasses several areas already discussed or will be discussed in the next post of the 10 most critical factors of SP payroll series.

- HRSP and CLC

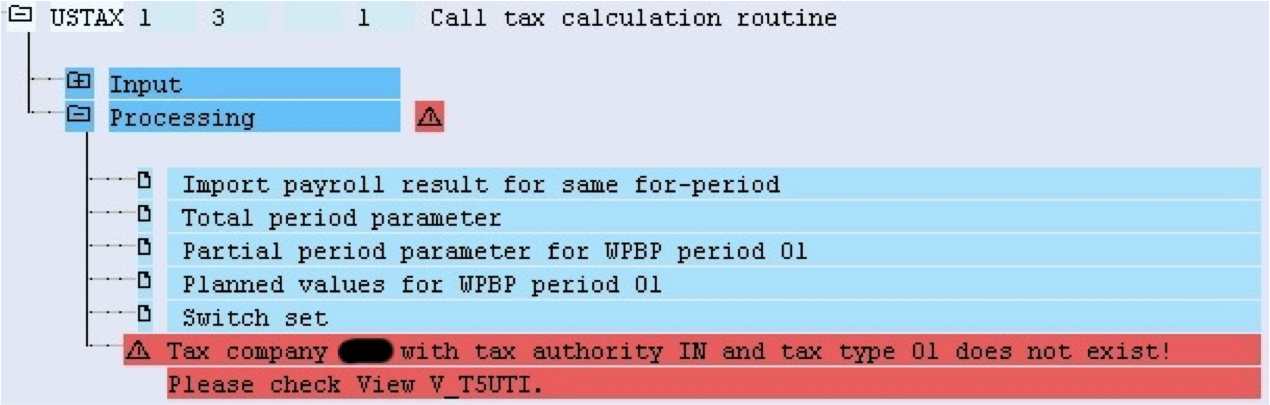

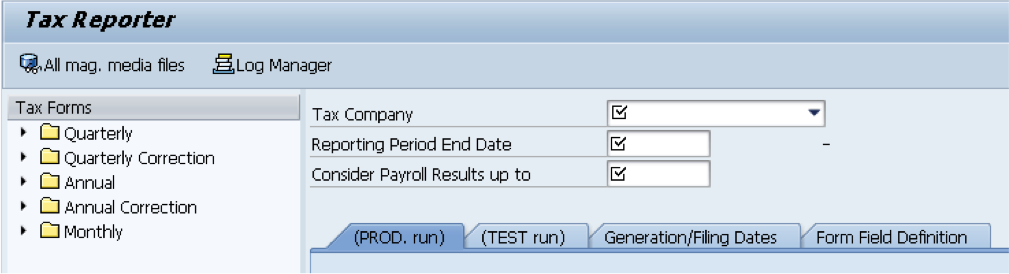

- Tax reporter and auditing

- Overpayments and claims

The year-end process should not begin in October, but should start immediately after annual tax reporting is complete for the previous year. The initial tasks should be a lessons learned document and business process documentation updates. This documentation will help us to not forget what we just went through in getting the previous year done.

Nailing down an exact schedule of the year-end project can be determined by looking up the tentative release schedule of HRSPs and CLCs on the SAP customer portal. We can then incorporate overlapping projects impacts and staff vacation scheduling. We want to have a detailed project plan just like any other project because year-end requires significant amounts of resources from payroll and other areas to apply updates, configure, etc. Luckily, the year-end project plan will look similar year after year so creating the detailed project plan will occur only once and then only tweaked from year to year.

Create a periodic process to run year-end reports and review to reduce the surge at year-end. Ongoing review will make it easier at year-end, but may also identify an issue earlier in the year and configuration or processes may be adjusted with less impact. Communications to employees confirming information such as addresses, marital status, and exemptions will also reduce year-end workload.

Please join us for our next blog post where we’ll discuss Overpayments and claims as another critical factor in SAP payroll.

Here at Integrated Consulting Group, we specialize in the design, development, and customization of SAP Human Capital Management business software for leading edge North American companies with global reach. Have any questions about SAP? Feel free to contact us via the contact page of our site, or on Twitter or LinkedIn.